One of the crucial pieces to pursuing FI early in life is your credit score, and Jordan knows it. He knows that his credit score plays a vital role in his future in numerous ways. Jordan understands the variety of ways his credit score can affect his life, and the same is true for you.

Let’s examine the ways Jordan is building his credit score so it can be an ally in his future financial plans. Then you will understand, as Jordan does, how building and maintaining a solid credit score is a MUST for your financial future.

Freak Speak: Sometimes, people refer to a “credit score” as a “FICO score.” They are essentially the same thing.

What is a credit score?

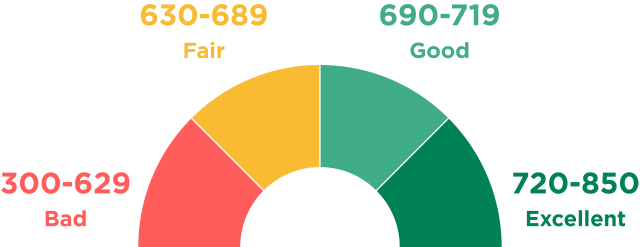

Jordan’s credit score is a 3-digit number. Right now, his is 615, but he knows it can be as low as 350 and as high as 850. The goal is to have a high score. Any score above 720 is considered “excellent,” and that’s where Jordan wants to be.

His current score of 615 is simply a numerical indicator of his trustworthiness and likeliness to pay his bills on time.

Jordan knows that three bureaus compute his credit score. Each bureau looks at his financial history and puts that information into a complex equation to arrive at a score. Jordan’s goal is to improve his financial history so that each bureau’s equation spits out a higher number.

The 3 Credit Score Bureaus

Why is a credit score important?

Jordan knows that the word “important” is a HUGE understatement. He realizes that an excellent credit score is significant, imperative, and essential to his financial future.

He appreciates that companies use his credit score to predict the likelihood that he will pay his bills on time, the probability that he will pay back the money he has borrowed, and the chances he will be a good employee.

Put simply – the higher his credit score, the less risky Jordan is as a tenant, employee, or borrower.

When someone wants to see Jordan’s credit score, they must first get his permission. Then they will ask each of the three bureaus for Jordan’s score. The scores from the three bureaus are usually very close, if not the same.

Companies will ask to see Jordan’s credit score when he:

- applies to rent an apartment or house

- buys a car with a car loan (which he shouldn’t do anyway)

- applies for a job

- wants to buy a real estate property (either as a place to live or as an investment)

- applies for a credit card (See Post 18 for options in getting your first credit card.)

- asks his car insurance provider how much he will have to pay

- inquires about staring a utility (cable, cell phone, natural gas, water, etc.)

A bad credit score can make all of these things very difficult for Jordan. A good credit score will help Jordan reach his goals much faster and with far fewer headaches.

So what is a good credit score, and how do you get one?

Jordan can have a credit score anywhere from 350 to 850. Right now, his is 615, and he wants to get it up to at least 720, which is the beginning of the “excellent” range.

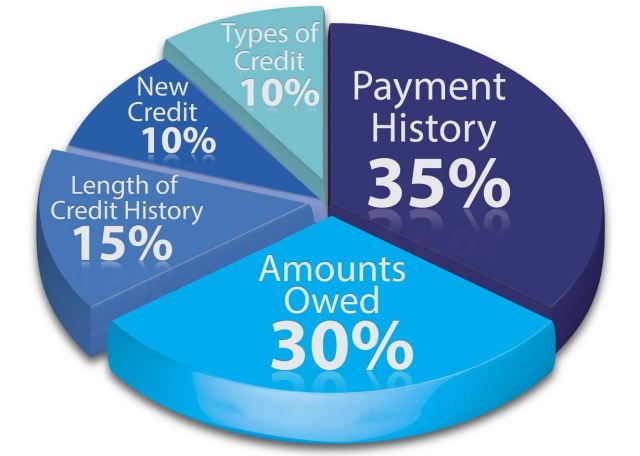

The three bureaus that calculate Jordan’s credit score all do it in pretty much the same way. His score is based on:

35% – Payment history: Does Jordan pay his bills on time?

30% – Amount owed: Does Jordan owe a ton of money?

15% – Length of credit history: How many years has Jordan been building his credit score?

10% – Credit mix: How many different types of accounts does Jordan have?

10% – New credit: How many companies have asked to see Jordan’s credit score in the last few months?

Based on the percentages above, Jordan understands that the best way to raise his credit score quickly is to have ONLY on-time payments (he plans never to miss a payment due date) and to keep the amount of money he owes low. The best way to keep it low is for Jordan to pay the balance on each credit card EVERY month.

Jordan knows that only some bills get reported to the credit score bureaus. The main ones are:

- Car loan payments

- Credit card accounts

- Mortgage payments

- Student loan payments

Based on these options, Jordan realizes that the best way for someone young like himself to build up their credit score is to get a credit card. But he knows that when he gets it, long-term responsible use is necessary to build and maintain his excellent credit. See Post 19 for the best strategies to manage a credit card.

Jordan also recognizes that many of the monthly bills he pays do NOT help build his credit score. But he also knows that if he doesn’t pay them on time, they will likely HURT his score. These include:

- Rent payments

- Utilities (gas, water, electricity, etc.)

- Cell phone bills

- Internet bill

- Insurance

[Some of these companies will check your credit score before you open an account with them, but once you have an account, they won’t report your on-time payments to the three credit bureaus.]

Jordan’s final advice

Establish a habit of paying EVERY monthly bill on time EVERY time. Don’t be late on one payment even once. Be a FREAK about paying your bills on time so your financial goals will be easier to reach with that 720+ credit score!

Leave a Reply